The Tides of Technological Convenience

The Rise of Instant Access and Customization

The method by which individuals secure protection has evolved at a breathtaking pace. In the not-so-distant past, securing a policy meant wrestling with stacks of paper, scheduling physical meetings, and navigating a labyrinth of jargon. Today, the smartphone has established itself as the primary gateway for consumers. Through dedicated applications and intuitive websites, users can now compare coverage options, modify terms instantly, and initiate coverage at their own convenience. This shift has transformed the industry into a service that is far more transparent and accessible to the average person, fitting seamlessly into the frantic pace of modern life.

Beyond mere convenience in application, the digital revolution has enabled a level of service personalization that was previously impossible. We are seeing a move away from "one size fits all" toward tailored experiences based on behavioral data. In the automotive sector, for example, telematics technology allows vehicles or mobile devices to track driving habits, rewarding safe drivers with preferential rates. Similarly, in the health sector, the integration of data from wearable fitness trackers allows providers to incentivize healthy lifestyle choices. The rigid plans of the past are being replaced by fluid, responsive structures that adapt to the individual’s daily life.

Furthermore, the "moment of truth"—when a claim is actually made—has been drastically accelerated. Historically, filing a claim was a slow process involving mailed forms and weeks of waiting. Now, many providers allow users to upload photos or videos of an incident directly to a platform, triggering automated assessment systems that can approve simple claims in minutes. Financial settlements are increasingly handled through instant digital payments rather than slow bank transfers. This immediacy provides a profound sense of security, proving that technological progress offers tangible emotional value by reducing stress during critical moments.

The Enduring Value of Human Expertise

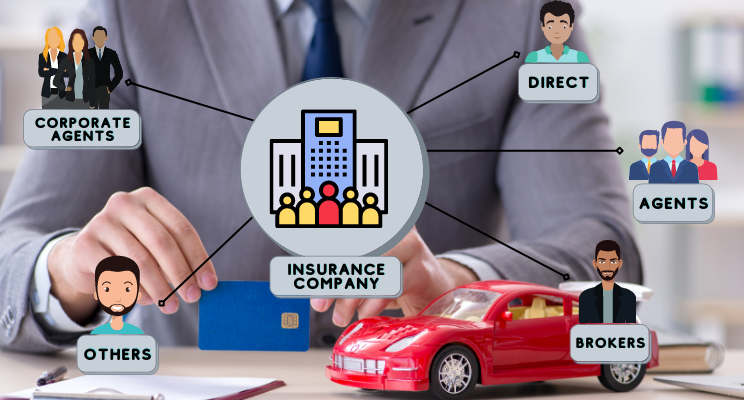

Despite the allure of digital speed, insurance remains an intangible promise, a contract that has become increasingly fragmented and complex over time. While tapping a screen to buy a policy is easy, ensuring that the chosen policy actually covers specific risks is a different challenge entirely. For the average consumer without industry knowledge, navigating the fine print among a sea of choices can be daunting. This is where the human element regains its foothold. Professional advisors play a crucial role as "translators," decoding complex terms and conditions into plain language that allows clients to make informed decisions rather than guesses.

Intermediaries who operate independently of a single carrier bring particular value here. Unlike a direct website that pushes its own product, these professionals can survey the broader market, comparing multiple carriers to find the best fit for a client’s specific risk profile. Whether it is a unique family situation or a complex business asset, they assemble coverage like a puzzle, offering flexibility that pre-packaged digital bundles often lack. They act as a filter, ensuring that efficiency does not come at the cost of coverage gaps.

Most importantly, the true worth of a human advisor is proven during a crisis. When a disaster strikes, the last thing a stressed policyholder wants is to navigate an automated phone menu or a chatbot. Being able to call a specific person who knows their history and can empathize with their situation offers a reassurance that algorithms cannot replicate. Advisors guide clients through the claims process, advocate for them against bureaucratic hurdles, and ensure fair treatment. In an age of automation, this high-touch, empathetic support remains the strongest asset for traditional channels, fostering a loyalty that purely transactional digital interfaces struggle to match.

| Feature Comparison | Automated Digital Channels | Professional Advisory Channels |

|---|---|---|

| Speed of Purchase | Immediate; completed in minutes via app or web. | Slower; requires consultation and analysis. |

| Complexity Handling | Best for simple, standardized products (e.g., auto, travel). | Essential for complex risks (e.g., business liability, life planning). |

| User Experience | Self-directed, highly efficient, low friction. | Guided, educational, relationship-focused. |

| Claims Support | Algorithms process simple claims instantly. | Advocacy and negotiation support for difficult claims. |

| Cost Sensitivity | often lower entry costs due to reduced overhead. | Value-added services may result in different pricing structures. |

Bridging the Gap: The Hybrid Approach

Harmonizing Tech and Talent

The industry is increasingly recognizing that the choice between silicon and soul is not a binary one. A "hybrid" model is emerging as the new standard, blending the efficiency of digital tools with the assurance of human oversight. This approach acknowledges a common consumer behavior: many people prefer to conduct initial research and get quick quotes online but hesitate to hit the "buy" button without validation from an expert. By integrating these channels, providers allow customers to move seamlessly between digital self-service and human consultation. A client might start an application on a tablet during their commute and finish it over the phone with an agent who has immediate access to the data already entered.

This integration benefits the providers as much as the customers. By offloading routine administrative tasks—such as address changes or simple renewals—to digital platforms, human agents are freed from low-value paperwork. This allows them to focus their time on high-value activities, such as comprehensive risk consulting and relationship building. Technology thus becomes an enabler rather than a replacement, augmenting the agent's ability to serve the client. For instance, data analytics can prompt an advisor when a client’s life stage changes, suggesting a timely review of their coverage.

For the consumer, this model offers the best of both worlds. They enjoy the autonomy of managing their account 24/7 while retaining a safety net. If they encounter a confusing clause or a technical issue, help is accessible. This synergy builds a more sustainable relationship; the ease of digital access prevents frustration, while the human connection fosters trust. As the market evolves, the winners will likely be those who can make the handoff between machine and human invisible, ensuring the customer feels supported regardless of the entry point.

Economic Forces and Strategic Rivalry

The Retention Puzzle and Financial Incentives

The rapid expansion of direct-to-consumer options has introduced a new volatility to the market. While digital channels excel at acquiring new customers through sleek interfaces and competitive pricing, they often struggle with retention. Data suggests that "self-service" customers, who purchase based on price and convenience alone, are far more likely to switch providers at the first sign of a better deal. Without the relationship anchor provided by a dedicated advisor, the emotional barrier to leaving is low. This high "churn" rate poses a significant challenge for insurers, as the cost of acquiring a new customer is substantial. Consequently, companies are realizing that while digital is great for volume, human channels are superior for value and longevity.

This dynamic is reshaping how compensation and incentives are structured. In an environment of economic uncertainty and inflation, the traditional commission models are under pressure. Insurers must balance the lower distribution costs of direct sales against the higher retention quality of agent-sold policies. To maintain a robust network of sellers, carriers are having to redesign remuneration to be more attractive, moving beyond simple volume-based payments. There is a growing trend toward "value-based" compensation, where intermediaries are rewarded not just for signing a contract, but for the profitability of the business, the loyalty of the customer, and the efficiency of risk management.

Simultaneously, the competition is no longer just about who has the lowest premium. It is about who has the most sustainable ecosystem. Companies are aggressively vying for the attention of top-tier intermediaries, knowing that a strong sales force is a buffer against market volatility. At the same time, they are investing heavily to make their direct channels more "sticky" by adding value-added services. The friction between expanding direct reach while keeping agency partners happy requires a delicate strategic balance. Ultimately, the market is shifting toward a model where the quality of the connection—whether digital or human—determines the financial viability of the provider.

| User Need | Recommended Channel Approach |

|---|---|

| Price Sensitivity | Direct/Digital: Ideal for users prioritizing lowest cost and speed for mandatory coverages like car insurance. |

| Asset Complexity | Agent/Broker: Essential for business owners or individuals with multiple assets (homes, boats, art) requiring bundled protection. |

| Tech Proficiency | Hybrid/Digital: High-tech users prefer app management but may need chat support; low-tech users require phone or in-person aid. |

| Long-term Planning | Agent/Broker: Life insurance and estate planning benefit significantly from an ongoing relationship with a consistent advisor. |

| Trust Requirement | Hybrid: Users who research online to verify credibility but purchase offline to ensure they haven't misunderstood terms. |

Q&A

-

What are Independent Agents and how do they function in the insurance industry?

Independent Agents are professionals who sell insurance products from multiple carriers, offering a variety of options to consumers. They function by assessing the needs of their clients and providing tailored solutions by comparing different policies. Unlike captive agents, who represent a single insurer, independent agents have the flexibility to find the best coverage for their clients from a range of insurers, often leading to better customer satisfaction and competitive pricing.

-

How do Direct-To-Consumer Models impact traditional broker networks?

Direct-To-Consumer (DTC) models allow insurers to sell products directly to customers, bypassing traditional broker networks. This approach can reduce costs associated with commissions and streamline the purchasing process. However, it also challenges broker networks by reducing their role in the distribution chain, which can lead to increased competition and a need for brokers to adapt by enhancing their service offerings or specializing in niche markets.

-

What role do Digital Platforms play in modern insurance distribution?

Digital Platforms play a crucial role by facilitating the distribution of insurance products through online channels. These platforms enable insurers to reach a broader audience efficiently and provide consumers with easy access to policy information, comparison tools, and purchasing options. The rise of digital platforms has led to increased market competition, as insurers must offer superior digital experiences to attract and retain customers.

-

How do Commission Structures affect market competition among insurance providers?

Commission Structures can significantly influence market competition by determining how agents and brokers are compensated for selling insurance products. A competitive commission structure can incentivize agents to prioritize certain products over others, affecting market dynamics. Insurers may adjust their commission structures to attract more agents or enhance their market share, which can lead to shifts in how products are marketed and sold.

-

In what ways does Market Competition drive innovation in the insurance industry?

Market Competition drives innovation by pushing insurers to develop new products, improve customer service, and adopt advanced technologies. To stay competitive, insurers must continuously enhance their offerings, whether through personalized insurance solutions, improved risk assessment tools, or efficient claims processing systems. This constant pressure to innovate benefits consumers by providing them with better options and more tailored insurance solutions.